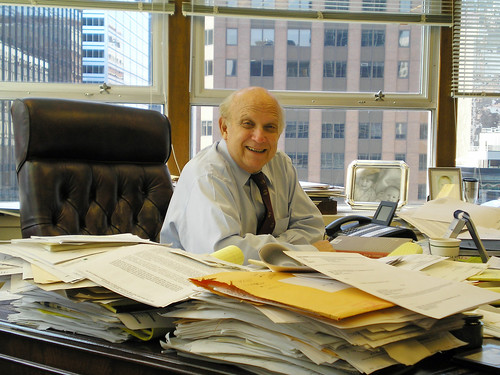

Photo: david_shankbone

- How can you help me with my circumstance? Most people going through utter loss of optimism tend to share their problem with nearly anyone. Before you do so with a lawyer, think once again. Ask this query first and allow them talk. In doing so, you’ll understand what they are seeking for in order to assist you, what they have noticed and dealt with, and how they were have the ability to identify regardless of whether or not they can really assist you. The more details you get from them, the better.

- Can you give me three individuals I can talk with whom you’ve got assisted to get their bank loan modified? Do not miss this opportunity and ensure you contact their references. Talking with their prior customers can be a good way to get suggestions and details about their capability to help you. Speaking to individuals they have earlier assisted is better than speaking with an additional person from the agency of the loan modification attorney; you need to avoid bias viewpoint.

- When do you intend to use violations of regulation in my current bank loan as leverage? In bank loan modification, you will find only two techniques: the easy as well as the hard way. The easy way fundamentally doesn’t include any principal reduction and only a modification according to the cost-effective monthly payment a borrower can give. The hard way consists of the negotiation of the principal reduction by means of violations of the regulation in loans. The loan modification attorney will go by means of all of your documents to cross check every little thing and look for loopholes. Both techniques are beneficial, but ought to be used accordingly.

- Just how much is the professional fee? This need to not be the very first query to ask them. The value of their service isn’t correlated to their success rate. Up front, they typically ask $0 to $3000 with a success fee of 2% of one’s bank loan.

- What help on with regards to my circumstance with the home lender could I anticipate? The potential lawyer’s reply to this query will give you a hint of their all round expertise. If the agency of the foreclosure lawyer features a dedicated person ready to take on your case, consider that a offer done. However, whenever they appear evasive and unsure; they are not adept to deal with your situation. Begin searching for an additional counsel.

Imelda Dilick is really a contributor that has a buddy at present in search to get a loan modification attorney. This person wants a foreclosure lawyer for his mortgage loan modification requirements.